Rumored Buzz on Paul B Insurance Medicare Part D

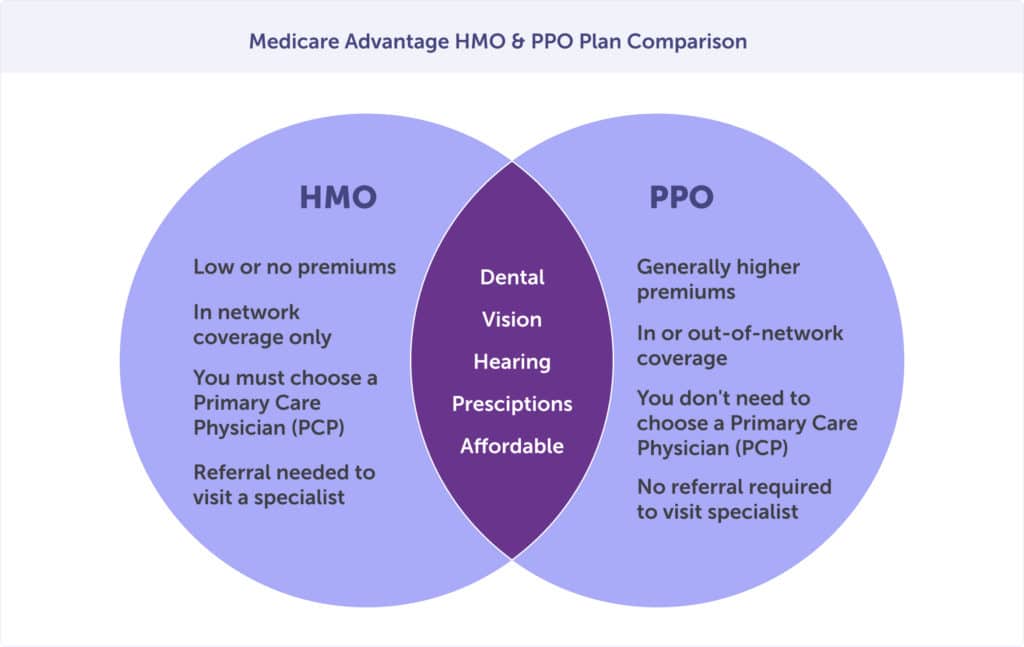

For many Americans who use Medicare insurance coverage, Medicare Advantage strategies are an excellent choice. Learn more about the concerns you ought to be asking to help you locate the finest Medicare coverage for you. There are many elements to think about when picking a Medicare Benefit plan or Initial Medicare. Prior to making a decision on which strategy to pick, it is essential to check out all your choices and weigh in prices as well as benefits to make a decision on the coverage that functions best for you.

Medicare beneficiaries pay nothing for many preventive services if the solutions are obtained from a medical professional or other wellness treatment supplier who takes part with Medicare (additionally recognized as accepting task). For some preventative services, the Medicare beneficiary pays nothing for the service, however might need to pay coinsurance for the office see to obtain these services - paul b insurance medicare part d.

The Welcome to Medicare physical examination is an one-time evaluation of your wellness, education and counseling concerning preventative solutions, and also recommendations for various other care if needed. Medicare will certainly cover this exam if you get it within the very first year of registering partly B. You will certainly pay absolutely nothing for the test if the doctor accepts assignment.

Paul B Insurance Medicare Part D for Beginners

On or after January 1, 2020, insurance companies are required to use either Strategy D or G along with An and B. The MACRA changes additionally produced a new high-deductible Plan G that might be provided starting January 1, 2020. For additional information on Medicare supplement insurance policy plan design/benefits, please see the Advantage Graph of Medicare Supplement Program.

Insurance providers might not refute the candidate a Medigap policy or make any kind of premium price distinctions due to wellness condition, declares experience, medical problem or whether the applicant is obtaining healthcare solutions. However, eligibility for plans offered on a team basis is restricted to those people who are participants of the group to which the plan is released.

Medicare Select is a kind of Medigap policy that needs insureds to use details healthcare facilities and sometimes specific medical professionals (except in an emergency situation) in order to be qualified for full advantages. Besides the restriction on hospitals as well as suppliers, Medicare Select plans should satisfy all the needs that put on a Medigap policy.

Paul B Insurance Medicare Part D Fundamentals Explained

When you use the Medicare Select network healthcare facilities as well as providers, Medicare pays its share of authorized costs and also the insurance policy firm is in charge of all additional advantages in the Medicare Select plan. In basic, Medicare Select policies are not required to pay any type of advantages if you do not utilize a network carrier for non-emergency solutions.

Currently no insurance providers are offering Medicare Select insurance coverage in New York State. Medicare Advantage Plans are accepted as well as regulated by the federal straight from the source government's Centers for Medicare and also Medicaid Solutions (CMS).

Prior to submitting any kind of insurance claims for care pertaining to a sensitive diagnosis, we informed Veterans of this modification by sending an one-time notification to all Professionals who had authorized a release of details declining to allow us to costs for care pertaining to a sensitive medical diagnosis in the past - paul b insurance medicare part d. The Federal Register likewise published this modification.

What Does Paul B Insurance Medicare Part D Do?

We're required by law to bill your medical insurance (including your spouse's insurance policy if you're covered under the policy). The cash gathered returns to VA clinical facilities to sustain health care sets you back given to all Veterans. paul b insurance medicare part d. You can submit a limitation request asking us not to divulge your health information for invoicing purposes, but we're not needed to give your demand.

You can additionally ask to talk with the billing office to find out more.

Rumored Buzz on Paul B Insurance Medicare Part D

If you have an Anthem Medicare Advantage strategy, you may be qualified for the Anthem Perks Prepaid Card, our Medicare flex card. You can use the card to conveniently access the costs allocations that come with your strategy. It can assist cover dental, vision, as well as hearing solutions as well as other expenditures like groceries, non-prescription things, utility costs, as well as much more.

Some plans may offer more advantages than are covered under Original Medicare. MA strategies are yearly agreements. Plans may make a decision not to negotiate or renew their contracts. Strategies might transform advantages, increase costs as well as increase copayments at the beginning of annually. You might have higher yearly out-of-pocket expenses than under Original Medicare with a Medicare supplement (Medigap) strategy.

Paul B Insurance Medicare Part D for Beginners

If you have an Anthem Medicare Benefit strategy, you might be eligible for the Anthem Benefits Prepaid Card, our Medicare flex card. You can make use of the card to conveniently access the spending allowances that feature your strategy. It can help cover oral, vision, as well as hearing solutions as well as other costs like groceries, over the counter products, energy costs, as well as a lot more.

As soon as you or your dependents become eligible for Medicare, the state pays additional, also if you do not register in visit the site Medicare. To prevent high out-of-pocket asserts costs (regarding 80 percent), you must register in Medicare Parts An as well as B as quickly as you are qualified as well as no more employed by the state.

Some plans may give even more benefits than are covered under Original Medicare. MA strategies are annual agreements. Plans may determine not to negotiate or renew their agreements. Strategies may change advantages, increase costs and boost copayments at the beginning of each year. You may have higher annual out-of-pocket expenses than under Original Medicare with a Medicare supplement (Medigap) strategy.